Book profit under section 115JB the purpose of computing.

The amount of income-tax computed in accordance with the preceding provisions of this Paragraph, or the provisions of section 111A or section 112 of the Income-tax Act, shall, in the case of every local authority, having a total income exceeding one crore rupees, be increased by a surcharge for the purposes of the Union calculated at the rate of twelve per cent.of such income-tax.

The Finance Act 2017 amended section 115JB of Income Tax Act, 1961 to rationalise the calculation of Book Profits for Companies that prepare their financial statements in accordance with Companies (Indian Accounting Standards) Rules, 2015 (hereinafter referred to as “Ind AS Compliant Companies”).

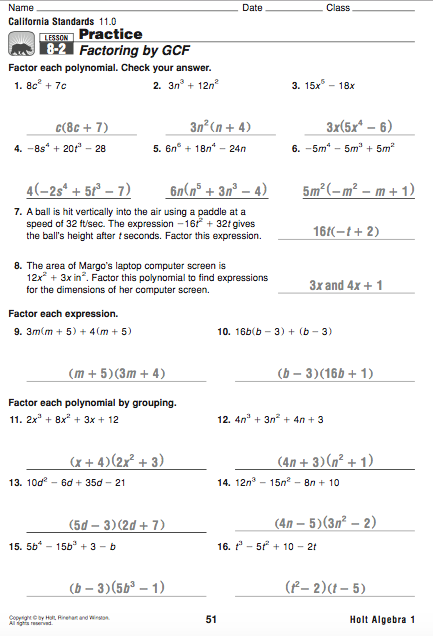

Calculation of 'Book Profits' for the Purpose of MAT (Section 115JB) Tax Credit in respect of Tax paid on Deemed Income under MAT Provisions (Section 115JAA) Amounts Expressively Allowed as Deduction (Section 30 to 37) Section 40A of Income Tax Act. ( Expenses or Payments not Deductible) Expenditure on Scientific Research (Section 35).

Things to Check Before e-filing Your Income Tax Returns. The following checklist will help you make necessary preparations before filing your Income Tax Return online:. Choose the right ITR form based on the source of your income. Check Form 26AS in order to verify your tax credit as per Form 16.; Make sure you have claimed all your previous deductions.

The Best Judgment Assessment is a procedure under the IT Act to comply with the principles of natural justice. Vide Section 144 of the Income Tax Act, 1961 the Assessing Officer is under an obligation to make an assessment of the total income or less to the best of his judgment in the following cases.

Clarifications on computation of book profit for the purposes of levy of Minimum Alternate Tax (MAT) under section 115JB of the Income-tax Act, 1961 for Indian Accounting Standards (Ind AS) compliant companies. Clarifications on computation of book profit for the purposes of levy of Minimum Alternate Tax (MAT) under section 115JB of the Income-tax Act, 1961 for Indian Accounting Standards (Ind.

We find from the provisions of DVC Act, 1948, the assessee Corporation does not conduct any annual general meeting. We hold that Section 115JB of Income Tax Act overrides all other provisions of Income Tax Act as it starts with a non obstante clause. Hence it is an independent code by itself.

Commissioners for Special Purposes of Income Tax v. Pemsel (1891) A.C. 531 Between:Commissioners for Special Purposes of Income Tax -Appellants. the meaning of the Income Tax Act, and that the allowance ought not to be granted in respect. and secondly whether the proper form of procedure is by mandamus. As to the first the principles laid.

What is Special provisions for payment of tax by certain persons other than a company? Section 115JC of Income Tax Act 1961 Special provisions for payment of tax by certain persons other than a company are defined under sections 115JC of Income Tax Act 1961.

Act 14, 2006, Act 18, 2006. An Act to consolidate and amend the law relating to the imposition, assessment and collection of tax on incomes. (Date of Commencement: 1st July, 1995.) PART I Preliminary (ss 1-2) 1. Short title This Act may be cited as the Income Tax Act. 2. Interpretation In this Act, unless the context otherwise requires-.

![]()

When Alternate, Minimum Tax is calculated, then the concept of brought forward loss and unabsorbed depreciation are taken into account and set-off for them is as per the Income Tax Act,1961. If a company is converted to a Limited Liability Partnership form of organisation, then the MAT credit, which the company earned is not allowed to be set-off against AMT.

The reprint consolidates the Income Tax Act, Cap 340, the Value Added Tax Act, Cap 349 and Statutory Instruments made thereunder since the revised edition of the Laws of Uganda 2000. Domestic Tax Laws Uganda - 1 - Disclaimer This reproduction of Uganda’s tax legislation is the personal effort of.

New Income Tax Form 10IC and 10ID for Companies Opting 115BAA or Section 115BAB. A domestic company opting for concessional tax rate schemes prescribed under section 115BAA or section 115BAB, can exercise this option by electronically filing Form 10-IC or Form 10-ID respectively.